Banks are already part of our lives since that time we could keep in mind. They may be our go-to spots when we should downpayment or withdraw income, make an application for financial loans, or create a fresh bank account. Even though we often associate the consumer banking knowledge of very long queues and slow-moving transaction speeds, the teller home window teller windows aspires to transform the way you banking institution. With this blog post, we’ll take a close look in the productivity of your teller window and why it’s quickly transforming into a popular choice for many.

Some time and Cost Benefits: One of the main benefits of the teller home window is its performance in saving time and expenses. Due to the innovative modern technology useful for purchases, banking procedures can be completed faster and straight away. This effective support will allow increased quantities of clients being served in little time, which results in considerable saving money for the lender and also the customers.

Customized Assistance: Although banking companies continue to introduce personal-service kiosks and cellular apps, the teller window preserves its customized assistance. Clients still value deal with-to-experience discussion with financial institution staff and will often choose to speak to a genuine individual when managing deals. Developing a teller window provides these with the opportunity to create connections with their banking institution, make inquiries and obtain individualized guidance on their finances.

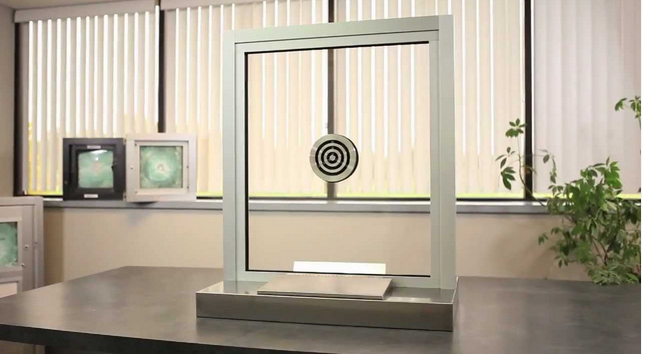

Safe Transactions: Security is so critical in relation to consumer banking providers, along with the teller windows provides a protect setting for transactions. With contemporary technology like biometric recognition, CCTV camcorders, and bulletproof glass, the teller windows supplies a secure and safe setting both for consumers and employees.

Comfort for your Elderly and Those with Handicaps: Accessibility is another major good thing about the teller windowpane. For consumers who call for guidance or people who have freedom issues, the teller window delivers efficiency and availability. It provides a comfy space for individuals that might require particular help, including individuals with wheelchairs or visual impairments, which makes it straightforward to allow them to perform financial transactions without having hindrance.

Accountability: Finally, the teller window offers an answerable system that ensures that every purchase is monitored and saved. Having a teller window ensures that all transactions are completed under watchful view and saved consequently. A customer can make sure their finances are getting handled responsibly on the bank.

In short:

To sum it up, the teller window has proven to be a competent, safe, and accessible way of business banking. With its customized assistance and accountability, it has become a well known option for many clients, especially the elderly and buyers with particular demands. With innovative technological innovation and effortless purchase processes, clients can comfortably execute their business banking transactions efficiently and quickly. Total, the teller windows aspires to transform the financial process by emphasizing the significance of customer care, safety, and availability.